-

Major mining firms employ thousands of miners and engineers, own large-scale equipment, have well-developed mineral processing and sales networks, and turn their massive throughput of minerals into a source of capital, which they can then risk in new mines.

-

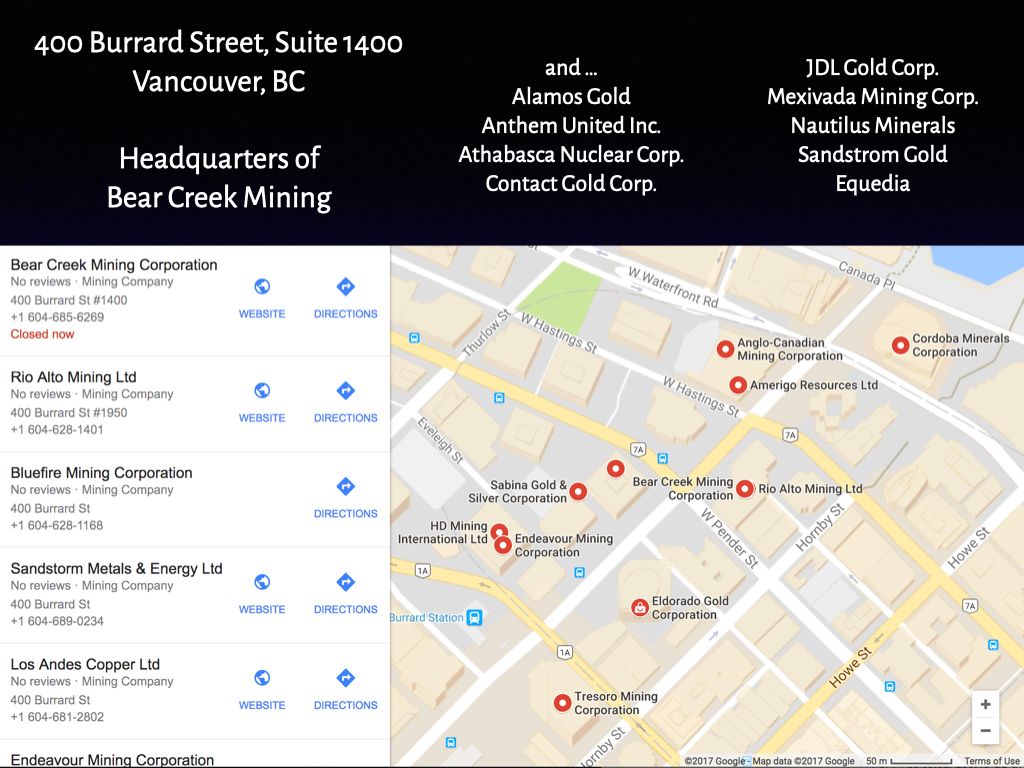

Junior mining firms like Bear Creek have none of these. Bear Creek's head office, suite 1400 of this building in Vancouver is shared with 9 other mining firms. Its Canadian payroll was just $1M/year. @CarwilBJ/1198060183148277760

-

Deeply offended, Bear Creek countered with expert witness statements arguing that junior mining firms are vital to the exploration and development of mines.

-

In turn, Peru said these tiny firms are unprepared for the realities of winning community approval for a mine, much less operating its successfully… Bear Creek, they argued before the ICSID, "maintains that it played no role in causing the region-wide social uprising that…

-

"…specifically demanded the cancellation of the Santa Ana Project. Such an implausible claim could only come from a company that had never before navigated the regulatory and social pathways needed to engage local communities and earn support for an operational mine."

-

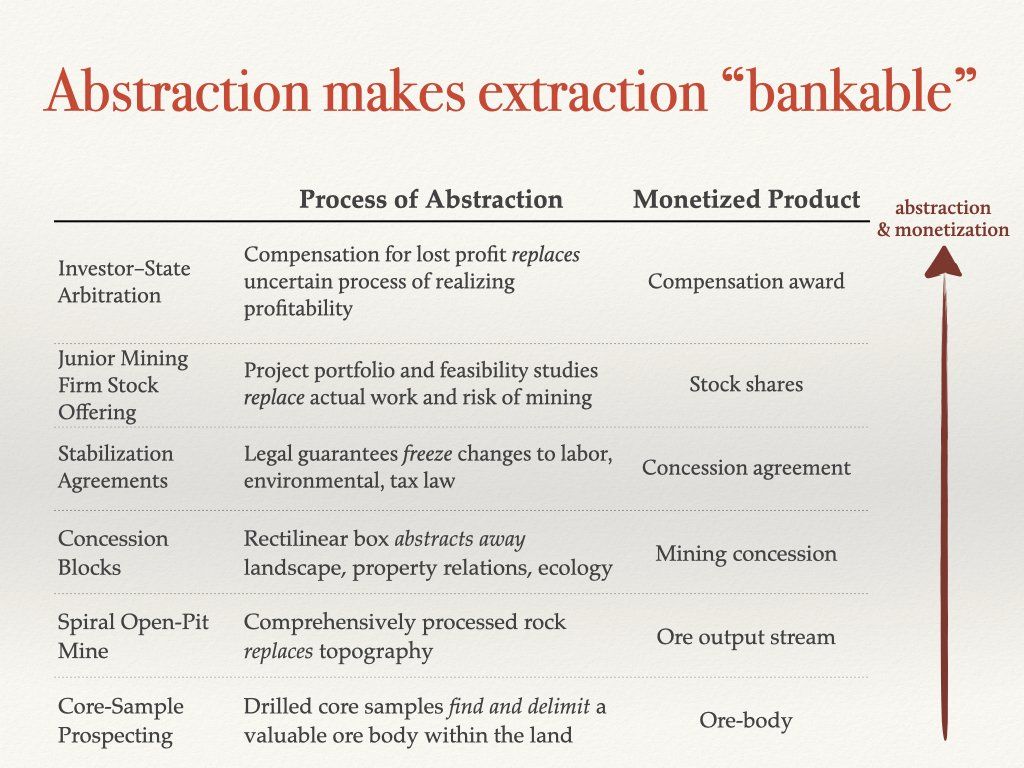

In any case, the long-term game plan of junior mining firms is to get bought out or "partnered" with by a major mining corporation.

-

However, the ecosystem of a few major mining firm and thousands of gossamer-winged junior mining start-ups makes life much harder on communities who land they covet…

-

Instead of a few majors making bets on where to place a mine next, hundreds of juniors are staking claims for damaging development.

-

These ventures are nearly invulnerable to public scrutiny or activist pressure in their home countries. In effect, the major mining corporations can outsource the economic and reputational risk of developing new mines, while drawing in speculative capital.

-

As the Aymarazo uprising against the Santa Ana mine shows, these projects are not invulnerable to community pressure. But pressure needed to be shifted from corporate targets to state mechanisms to be effective.

-

Video of the talk is here: youtube.com/watch?v=39OdBsNe9lE