-

This redefined corporations as purely objects of shareholder value, unbeholden to other stakeholders: workers, host communities, public reputation etc.

-

Karen Ho: The Wall Street takeover was aided by academic voices, who were "fundamentally uncomfortable with the modern corporation," described it as "schizophrenic," "organized anarchy"…

-

e.g., Michael Jensen, "logically impossible to maximize in more than one dimension" "If there had to be just one objective of the corporation, maximizing shareholder value was the obvious choice."

-

This converged with social scientists who critiqued the failures of bureaucratic organizations as overly rigid and inflexible.

-

So we can think of the "vanishing American corporation": Many fewer stock-exchange listed corporations than before.

-

Most public corporations today are owned by funds: BlackRock has 5% in 1,803 corporations. Fidelity is largest shareholder of 10% of corporations. Average lifespan of public company has fallen from 75 years to 15.

-

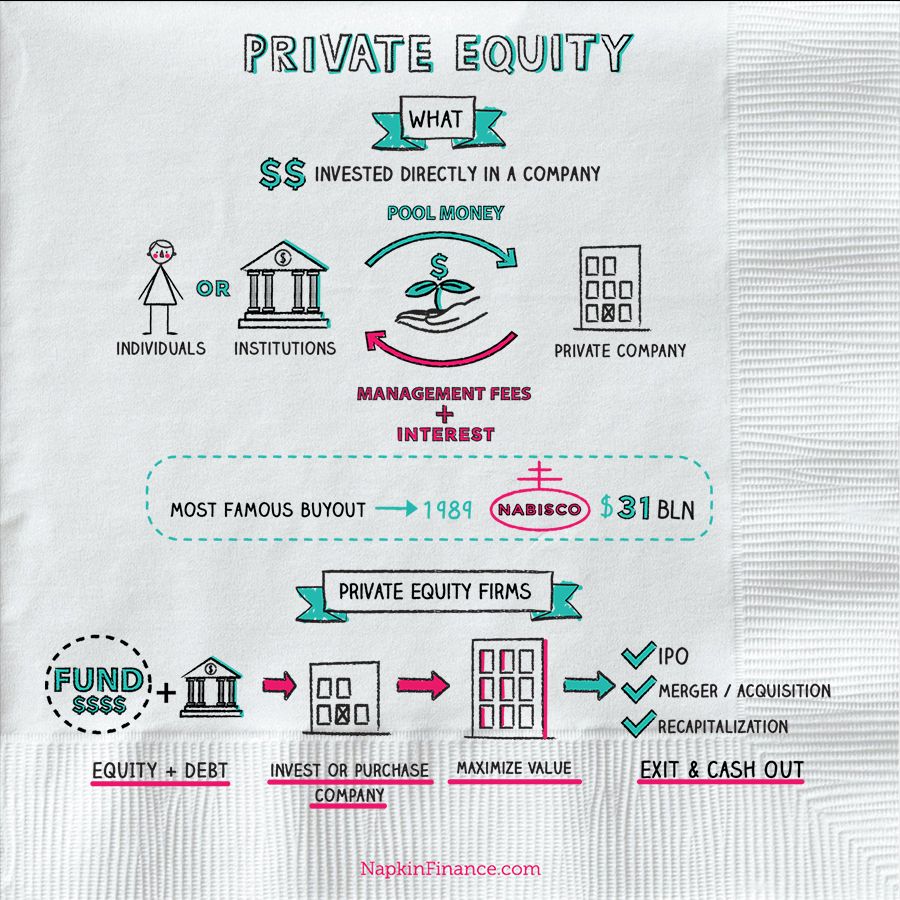

When held by private equity funds, corporations become "portfolio corporations," only valuable based on changes in stock prices.

-

For example, Harry & David fruit company redirected towards returns to its Wall Street owners, then sent into bankruptcy, a public pension bailout, and finally sold to 1-800-FLOWERS. articles.latimes.com/2011/mar/29/business/la-fi-harry-and-david-20110329

-

The Capitalist Dilemma: "Doing the right thing for long-term prosperity is the wrong thing for most investors." (published in Harvard Business Review: hbr.org/2014/06/the-capitalists-dilemma)

-

Redirection of corporate profits to buy back company's stock diverts away from productive investment… e.g., Exxon, Microsoft, IBM, Cisco, Procter & Gamble. hbr.org/2014/09/profits-without-prosperity